When it comes to navigating the complex world of financial markets, technical indicators are indispensable tools for traders and investors. These metrics provide valuable insights into market trends, price movements, and potential trading opportunities. However, choosing the right technical indicators for analysis can be a daunting task. In this article, we will delve deep into the realm of technical indicators, offering guidance on selecting the most suitable tools for your analysis needs.

The Importance of Technical Indicators

Technical indicators serve as the backbone of technical analysis, a method used to forecast future price movements based on historical data. They help traders and investors make informed decisions by providing valuable information about market trends, momentum, volatility, and potential reversals.

Understanding Technical Indicators

Before we dive into the selection process, let’s gain a clear understanding of what technical indicators are and how they work.

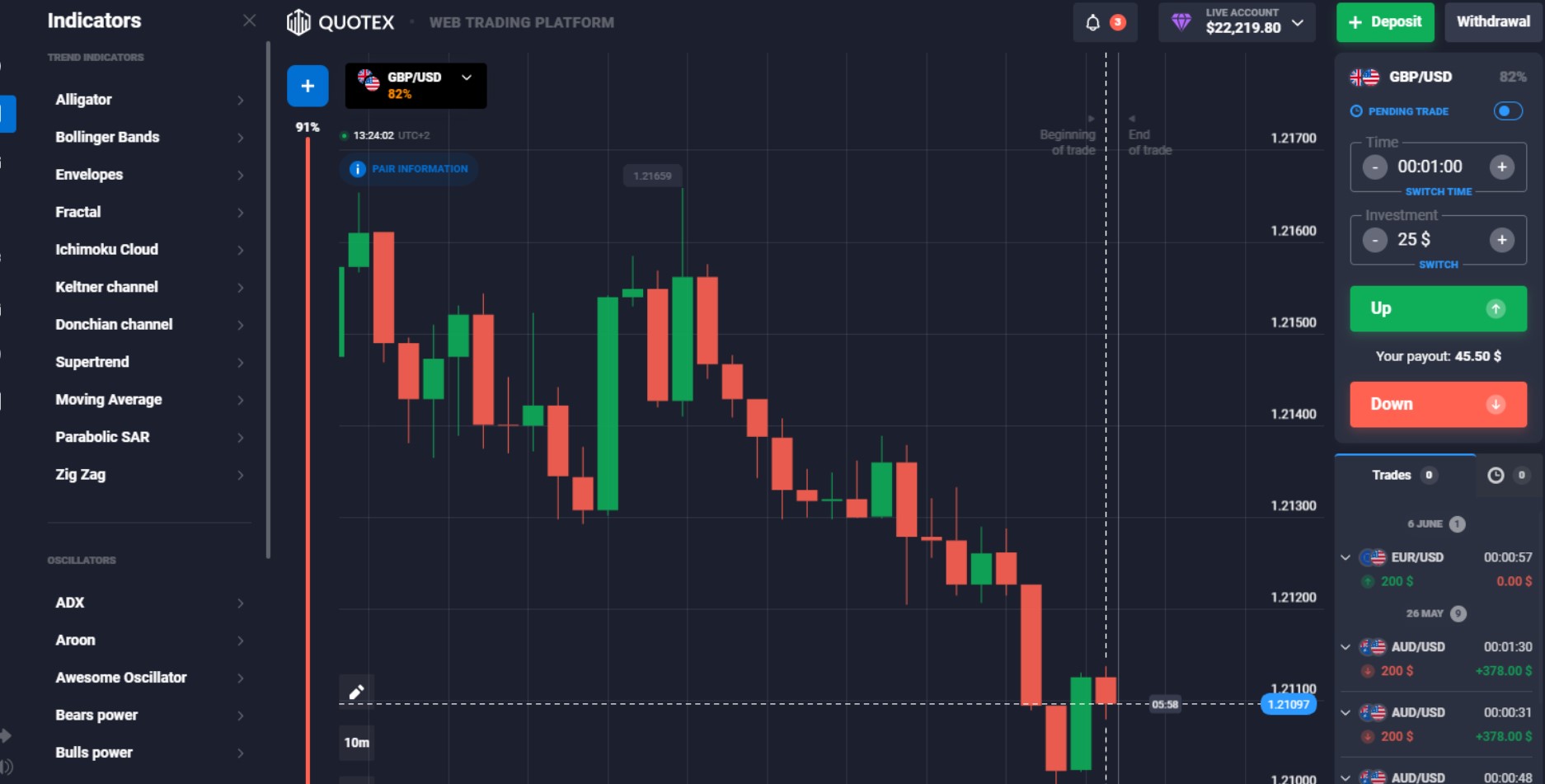

Technical indicators are mathematical calculations applied to historical price, volume, or open interest data. These calculations result in visual representations, typically plotted on price charts, to help traders identify patterns and trends.

Types of Technical Indicators

Not all technical indicators are created equal. They can be broadly categorized into four main types:

1. Trend Following Indicators

These indicators help traders identify and follow established trends. Examples include Moving Averages and Average Directional Index (ADX).

2. Oscillators

Oscillators are used to identify overbought and oversold conditions in the market, potentially signaling a reversal. Common oscillators include the Relative Strength Index (RSI) and the Stochastic Oscillator.

3. Volatility Indicators

Volatility indicators measure the degree of price fluctuations in the market. Bollinger Bands and Average True Range (ATR) are popular examples.

4. Volume Indicators

Volume indicators provide insights into trading activity and can confirm trends. On-Balance Volume (OBV) and the Chaikin Oscillator fall into this category.

Selecting the Right Tools

Now that we’ve covered the basics, let’s explore how to choose the right technical indicators for your analysis:

Identifying Your Trading Style

Different trading styles require different sets of indicators. Are you a day trader, swing trader, or long-term investor? Tailor your indicator selection to match your trading horizon.

Analyzing Market Conditions

Consider the current market conditions. Is it trending, ranging, or experiencing high volatility? Select indicators that align with the prevailing conditions.

| Market Condition | Description | Suitable Indicators |

| Trending Market | A market where prices consistently move in one direction over time. | Moving Averages, MACD, Ichimoku Cloud |

| Ranging Market | A market characterized by sideways or horizontal price movements with no clear trend. | Bollinger Bands, Stochastic Oscillator, RSI |

| Volatile Market | A market with rapid and unpredictable price fluctuations. | Average True Range (ATR), Volatility Index, Chaikin Oscillator |

Analyzing market conditions is a critical step in selecting the right technical indicators for your trading or investment strategy. Different market conditions require different sets of indicators to provide meaningful insights. Here’s a breakdown of how to approach each type of market condition:

- Trending Market:

- Description: In a trending market, prices consistently move in one direction, either up (bullish) or down (bearish), over a period of time.

- Suitable Indicators: To identify trends and potential entry or exit points, consider using Moving Averages, the Moving Average Convergence Divergence (MACD) indicator, or the Ichimoku Cloud.

- Ranging Market:

- Description: A ranging market exhibits sideways or horizontal price movements, with no clear trend in either direction.

- Suitable Indicators: In a ranging market, focus on indicators like Bollinger Bands, the Stochastic Oscillator, or the Relative Strength Index (RSI) to identify potential reversals at key support and resistance levels.

- Volatile Market:

- Description: Volatile markets are characterized by rapid and unpredictable price fluctuations, often accompanied by increased trading volume.

- Suitable Indicators: To navigate high volatility, consider using indicators such as the Average True Range (ATR), Volatility Index, or the Chaikin Oscillator to gauge the intensity of price swings and potential entry points.

Remember that market conditions can change, and it’s essential to adapt your indicator selection accordingly. Traders often use a combination of indicators to gain a more comprehensive view of the market and increase the accuracy of their analysis.

By assessing current market conditions and selecting appropriate indicators, you can enhance your ability to make well-informed trading decisions and capitalize on opportunities in the financial markets.

Avoiding Overcomplication

In the world of trading and investing, it’s easy to get drawn into the allure of a vast array of technical indicators. The abundance of tools available can be tempting, but there’s a crucial principle to remember: simplicity often leads to better results.

Using too many indicators simultaneously can overwhelm you with conflicting signals and obscure the clarity of your analysis. Instead, it’s advisable to stick to a handful of well-understood indicators that align with your trading strategy and the prevailing market conditions. This approach allows you to develop a deep understanding of your chosen indicators, making it easier to interpret their signals accurately.

In essence, less can often be more when it comes to technical indicators. By avoiding overcomplication and focusing on a select few, you can streamline your analysis process, gain confidence in your decisions, and ultimately improve your trading outcomes.

Backtesting and Validation

Before implementing any indicator, conduct thorough backtesting to ensure its effectiveness in your chosen market.

FAQs

Q: How do I know which technical indicators are the most accurate? A: The accuracy of an indicator depends on market conditions and your trading style. It’s essential to backtest and validate indicators in your chosen market to determine their accuracy.

Q: Can I use multiple indicators simultaneously? A: Yes, you can use multiple indicators, but be cautious not to overcomplicate your analysis. It’s often more effective to combine indicators that complement each other.

Q: What are the best indicators for day trading? A: Day traders often use indicators like Moving Averages, RSI, and Volume Profile to identify short-term trends and trading opportunities.

Q: Are there free resources for learning about technical indicators? A: Yes, there are many free online resources, including tutorials, articles, and forums, where you can learn about technical indicators.

Q: Should I rely solely on technical indicators for trading decisions? A: It’s advisable to use technical indicators in conjunction with fundamental analysis and market sentiment for well-rounded trading decisions.

Q: How can I access real-time data for technical analysis? A: Many trading platforms and financial websites offer real-time data and charting tools for technical analysis.

In the world of finance, the ability to make informed decisions is paramount. Technical indicators are invaluable tools for traders and investors seeking an edge in the market. By understanding the different types of indicators, selecting the right ones for your strategy, and using them judiciously, you can navigate the complexities of the financial markets with confidence.

Remember, the key to successful technical analysis lies not only in the tools you choose but also in how you apply them. Continuously educate yourself, adapt to changing market conditions, and refine your analysis skills to stay ahead in the dynamic world of finance.